SMP

Supply tightness in SMP is felt the world over

Europe

Import demand heats up EU markets

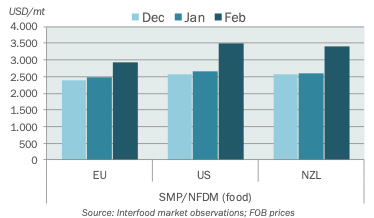

In the few days after the early February GDT the EU SMP market was on fire. The buyside sentiment was driven by fear of missing out and the trickle-down effect of tight supply in the US and in Oceania. Importers began to look increasingly at the EU for product and despite solid supply of milk throughout the EU, the demand became so strong that local EU buyers were sometimes left empty handed. The price increased every day and peaked at about EUR 2600-2700 ex works for Q2 delivery. By the start of the second week of February, though, the bubble burst and prices eased to EUR 2400-2500 ex works.

Americas

NFDM price appreciates by a third in just one month

The US NFDM market is experiencing a short squeeze that has been driving prices up on a daily basis in the past three weeks. The early February price is USD 1.58-1.60/lb (3485-3525/t) ex works for Western NFDM, where the market is somewhat less tight than in the Midwest and the East. In those regions the pull from the new production lines in the cheese plants is even stronger and prices are at least a few cents per lb higher. With the alternative outlets of UF milk and Class II products continuing to absorb so much milk, there is further upside pressure to be expected for NFDM. Pricewise we may expect some relief from the ramping up of milk production towards the flush, but beyond that the protein market is expected to remain tight.

Asia-Pacific

SMP price rises extremely fast after GDT

It was not surprising that the ongoing tightness in the SMP market in the region did result in higher price levels on the early February GDT, which was dominated by Chinese buyers. However, what evolved in the next few days after the GDT session was surely unexpected, as the price continued to rise almost by the hour. Two days after the event the market price for SMP had risen to USD 3400 FOB, and the end of the increase was not in sight. The supply side seems to be sold out until the end of Q2 and there are many buyers that still have to secure product for nearby delivery. Finding alternative supply on the world market is difficult as the powder market in the US is also very tight and the prices in the EU are swiftly rising as well.

More insights

If you're interested in SMP, you may also like these topics: