FCMP

Sell side is in the driver’s seat

Europe

FCMP price increases follow at a distance

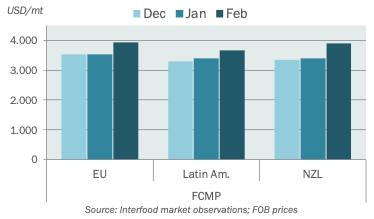

The EU FCMP market price is determined by the dynamics on the butter and the SMP markets. As the prices for fat rose less swiftly than those for protein the price appreciation for FCMP was relatively modest. It needs to sell for at least EUR 3280-3380 ex works in order to make processing economically viable. This indicates also that this type of powder continues to be processed once a sales contract has been agreed on.

Americas

Tighter supply pushes prices up

When ONIL finally came to the market around mid-January suppliers from South America succeeded to secure a large chunk of the FCMP volumes. The sell side is now much more relaxed and with the off season approaching the availability for prompt and the next three months has tightened considerably. Brazilian buying has returned as well and with the further tail wind provided by the price increases on the early February GDT the FCMP price level in LA has risen to USD 3750 FOB.

Asia-Pacific

Prices increase at a more modest pace

The FCMP price in APAC has appreciated as well but at a much slower speed than that of SMP. There appears to be sufficient supply still but buyers continue to chase volumes despite increasing prices. There is demand for Q2 delivery for sure but the buyside is also beginning to look at Q3 and Q4. The current price level is about USD 3900 FOB for Q2 and Q3 futures are around USD 3800. China remained by far the largest buyer at the early February GDT, followed by the Middle East and SE Asia, whose participations were slightly lower than earlier this year.

More insights

If you're interested in FCMP, you may also like these topics: