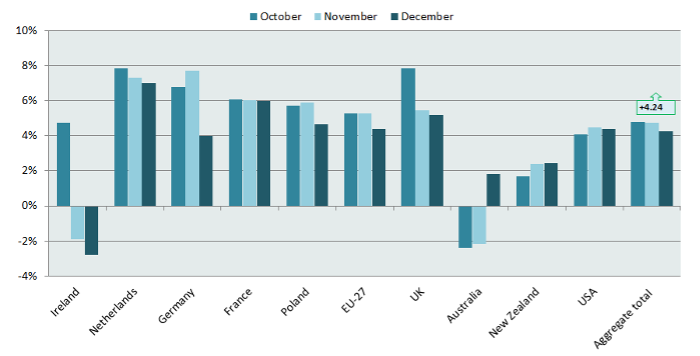

Milk in key exporting regions

%-change versus previous year

Europe

Liquids prices do not follow commodity prices upward as processing capacity is limited

Milk production throughout the EU remains abundant, but prices of dairy liquids fail to follow in the footsteps of the commodity markets due to lack of processing capacity. Sales of spot milk remain challenging. Dutch spot milk trades at EUR 0.17-0.19. French spot milk benefits from lively demand in Spain which pushed prices up to EUR 0.21. German spot milk prices on the other hand weakened a bit recently to a level of around EUR 0.16 due to Italian demand slowing down after local Italian milk output strengthened. Spot cream prices are at EUR 3.80-3.90, which remains too low compared to where butter prices are. All prices are ex works.

Americas

How long will US milk production growth stay this strong?

US milk production reportedly gets affected by the severe winter weather conditions at the moment but the latest December production data still indicate an increase of more than 4% over last year. Going forward it is difficult to forecast the longevity of the US supply strength. Farmer cash flows are still supported by positive side returns in beef and energy, but heifer availability is very limited. Therefore, milk production can from this point onwards only be boosted by cow productivity, which strongly depends on feed availability and feed prices.

Asia-Pacific

Buyers are in the dark about end of season product availability

As usual during this time of the year market participants try to gauge the actual end of season product availability in Oceania. In December Australia produced a positive growth rate for the first time in the season and New Zealand continued its strong performance during all of this season with a +2.5% in December. So it seems like availability can’t be that much of a challenge. Still, demand is very strong in the region since prices started to appreciate in early January. Therefore buyers are getting nervous whether they can get their hands on sufficient product from their preferred regions suppliers.

More insights

If you're interested in Milk, you may also like these topics: